Now Reading: Asian Stocks Edge Higher as Traders Await Fed Meet: Markets Wrap

-

01

Asian Stocks Edge Higher as Traders Await Fed Meet: Markets Wrap

Asian Stocks Edge Higher as Traders Await Fed Meet: Markets Wrap

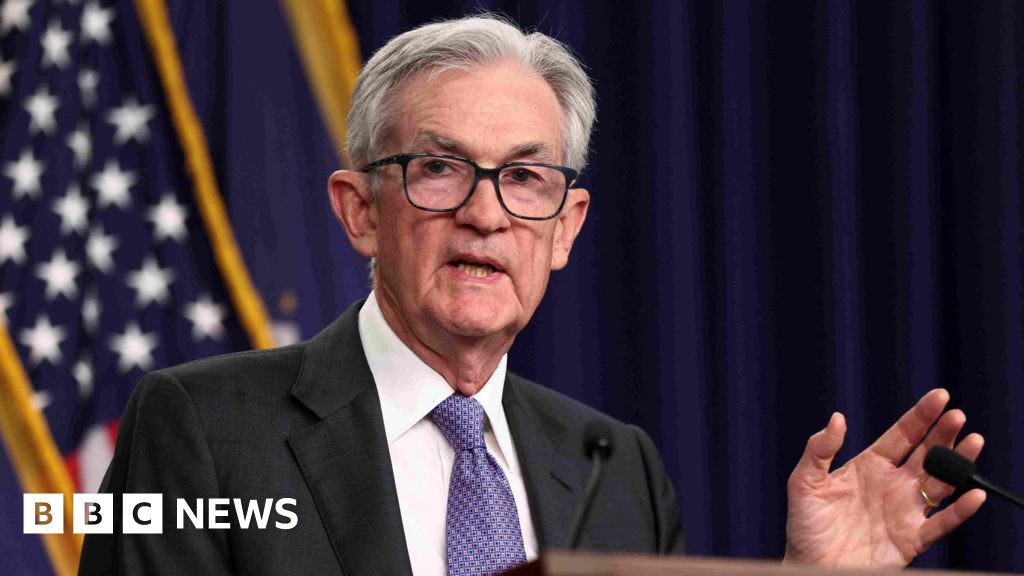

(Bloomberg) — Asian shares drifted higher in range-bound trade, as investors braced for the Federal Reserve’s final policy decision of the year.

Most Read from Bloomberg

A gauge of regional stocks rose 0.3% after a three-day loss, with gains in Hong Kong and mainland China offsetting declines in Japan and Australia. US futures ticked higher after both the S&P 500 and Nasdaq 100 shed 0.4% Tuesday.

Shares of Nissan Motor Co. jumped as much as 24%, the most since at least 1974, on news that the ailing carmaker is exploring a possible merger with Honda Motor Co. The latter’s stock dropped.

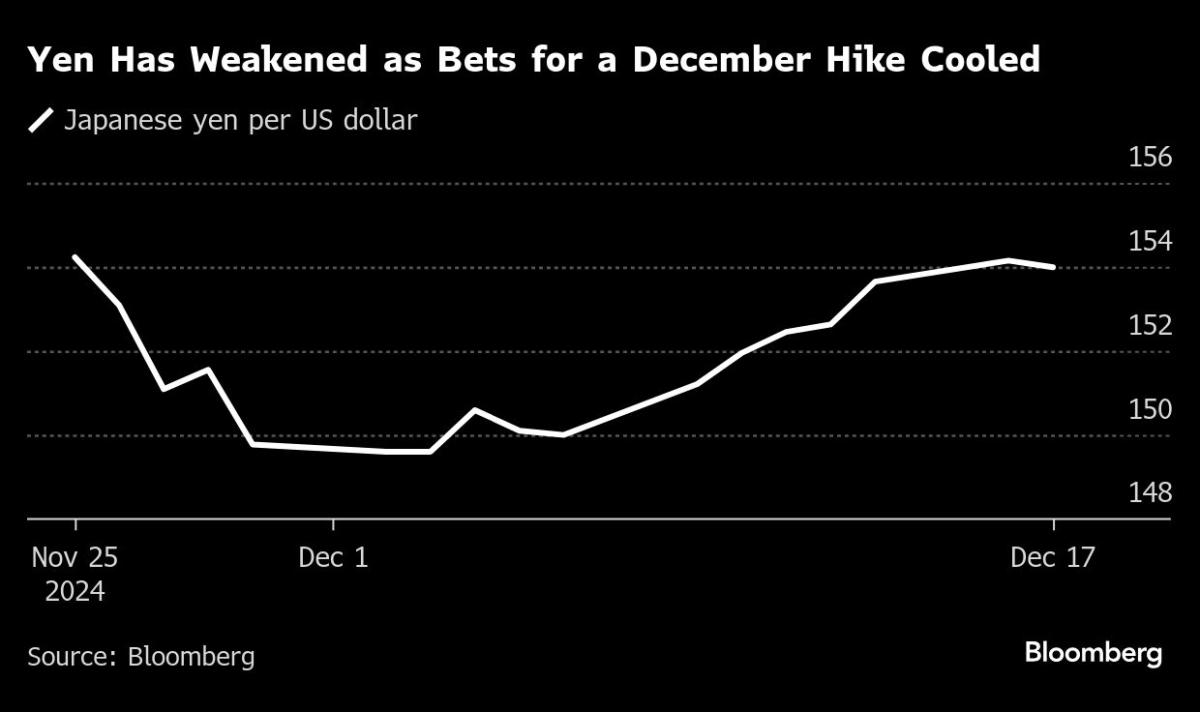

Treasuries rose slightly while Bloomberg’s dollar gauge was little changed. The yen turned steady ahead of the Bank of Japan’s policy decision Thursday.

“It’s year-end so volumes are light and the move is small,” said Vey-Sern Ling, managing director at Union Bancaire Privee. “As we go into 2025, it’s quite clear that the China government will continue to do more to support their economy and these measures whether sufficient or not in real terms can serve as potential catalysts to drive the markets higher.”

While the Fed is widely expected to cut interest rates by another 25 basis points on Wednesday, the focus is on its outlook for next year given Donald Trump’s proposed policies that may rekindle inflation. The central bank’s meeting also comes as US economic data showed a mixed picture, with retail sales increasing at a firm pace and industrial production unexpectedly declining.

Bank of America Corp. sees the Fed lowering interest rates to the 3.75% level — or three more cuts from where they are currently, Chief Executive Officer Brian Moynihan said on Bloomberg Television.

“They need to bring it down a little bit, they just have to be more careful because the economy is stronger than we thought three months ago, six months ago but still has potential weaknesses” he said. “We haven’t even talked about what is going on outside the United States that could affect it — not tariffs but wars.”

Back in Asia, a gauge of Hong Kong-listed Chinese tech stocks rose as much as 2.3%, shrugging off news that the US is set to initiate a trade investigation into the country’s semiconductors in the coming days. The onshore CSI 300 Index gained 0.8%, after President Xi Jinping urged officials to “scientifically” plan economic and social development work for 2025 and seek a good start for the new year.

Still in China, longer-dated government debt fell as a media report on the central bank’s discussions about risks for financial institutions renewed concerns over authorities’ pushback against a relentless bond rally.