Now Reading: Europe markets: Stocks, earnings, live updates

-

01

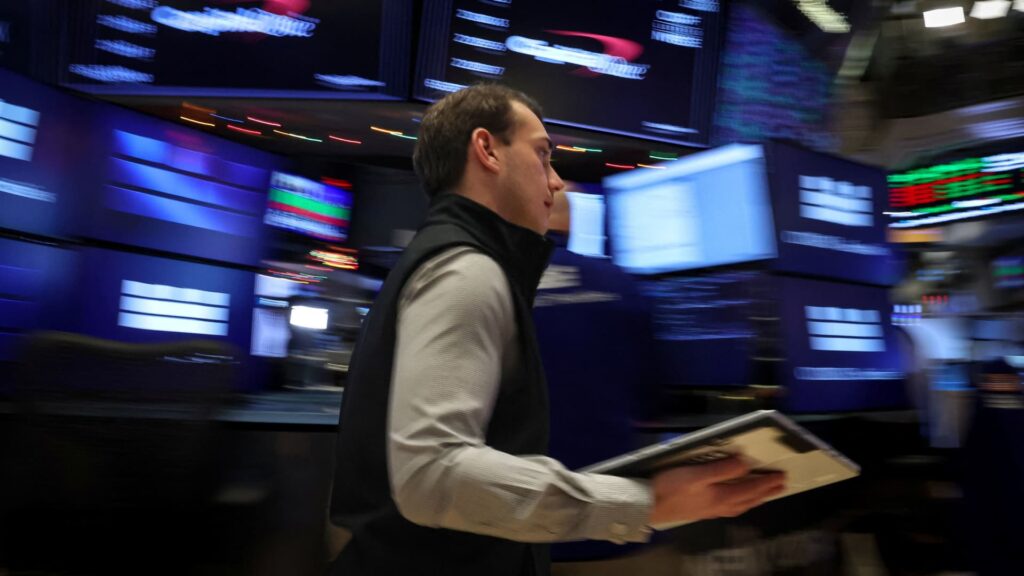

Europe markets: Stocks, earnings, live updates

Europe markets: Stocks, earnings, live updates

European stocks had a positive start to Friday’s trading session, after the U.K. and U.S. confirmed a trade agreement and as investors looked ahead to U.S.-China trade negotiations set to begin this weekend.

The pan-European Stoxx Europe 600 index was 0.4% higher by 9:41 a.m. in London. The U.K.’s FTSE 100 gained 0.4%, while Germany’s DAX and France’s CAC 40 each gained more than 0.5%.

On Thursday, most major European indexes closed higher. However, the U.K.’s FTSE 100 bucked the trend to tumble 0.32% after snapping its record winning streak on Wednesday.

Over the coming weekend, U.S. Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer are set to meet with top Chinese officials in Switzerland for talks on economic and trade issues. Bessent previously said the meeting was about “de-escalation, not … the big trade deal.”

China and the U.S. are currently embroiled in a trade war, after they slapped tariffs of well above 100% on each other.

The weekend’s talks come after the U.S. announced the framework for a trade deal with the U.K., the first it has agreed upon since Trump revealed his “so-called” reciprocal tariffs system last month. Under the deal, the U.K. can export 100,000 vehicles each year to the U.S. at a 10% tariff rate, with any additional vehicles facing 25% duties. British steelmakers and the aluminum industry will be able to export tariff-free, down from the 25% rate that the U.S. imposed in February.

However, all other goods imported to the U.S. from the U.K. will still be subject to a 10% baseline tariff.

Regional investors will also be digesting earnings updates on Friday from German lender Commerzbank, an acquisition target for UniCredit. Portugal’s utility company EDP is also revealing its quarterly results after a major power outage earlier this month.

Asia-Pacific markets were mixed Friday as investors parsed China’s April trade data.

China’s exports surged in April even as businesses bore the brunt of U.S. tariffs that kicked into higher gear last month, while imports narrowed declines as Beijing stepped up stimulus.

On Wall Street, futures tied to the Dow Jones Industrial Average fell 52 points, or 0.1%. Nasdaq 100 futures slipped 0.08%, while S&P 500 futures were off about 0.1%.