Now Reading: Stock market today: Live updates

-

01

Stock market today: Live updates

Stock market today: Live updates

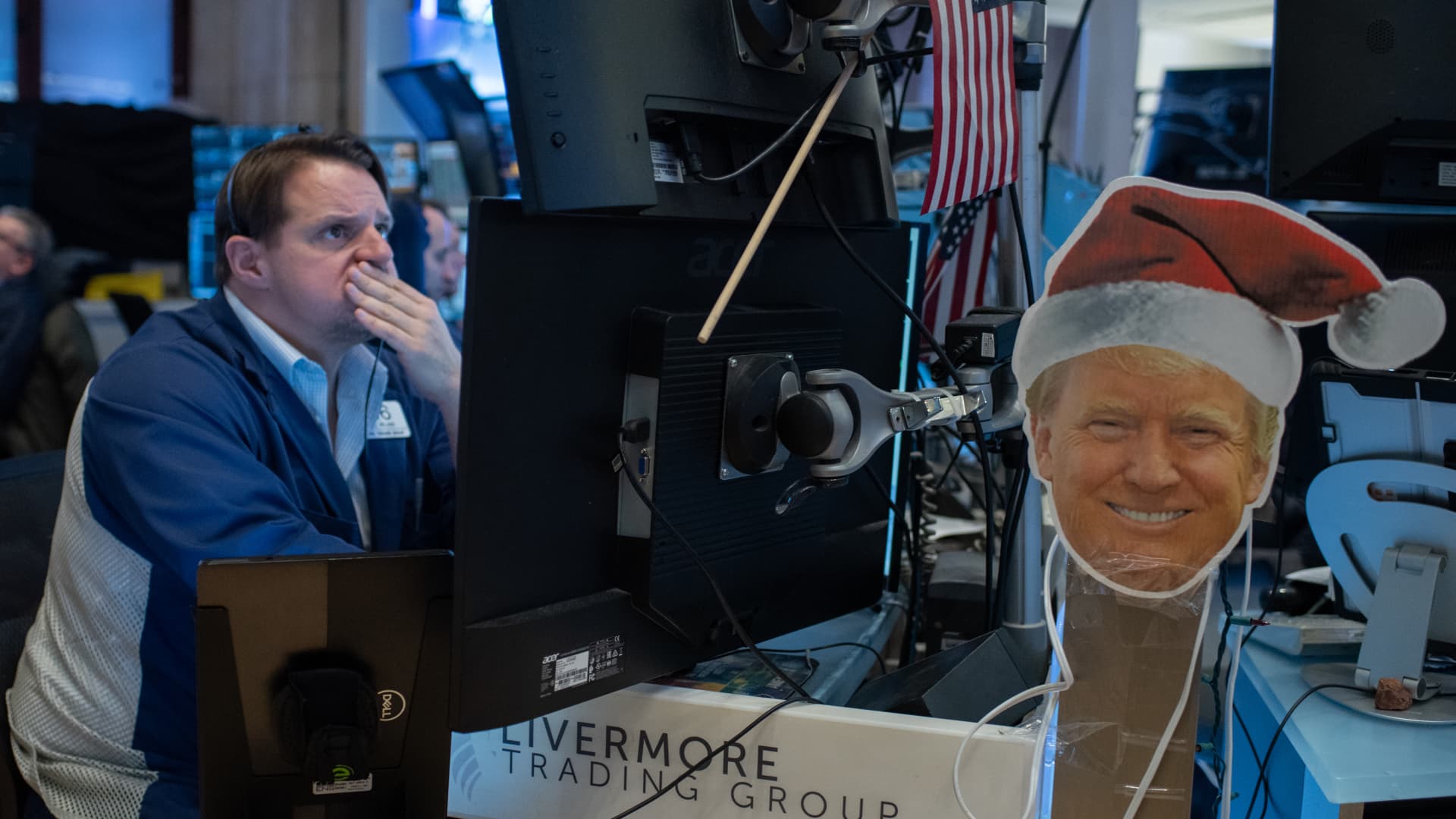

Traders work on the floor of the New York Stock Exchange on Feb. 13, 2025.

Danielle DeVries | CNBC

Stock futures jumped early Monday on reports President Donald Trump was planning on holding back some of the tariffs initially planned for April 2, raising hopes the U.S. won’t plunge the globe into an all-out trade war.

Futures tied to the Dow Jones Industrial Average advanced 391 points, or 0.9%. S&P 500 futures added 1.2%, while Nasdaq 100 futures were 1.5% higher.

Shares of Tesla, which have fallen nine straight weeks, were up 3.6% in premarket trading Monday. Meta shares added 3%, while Nvidia shares rose nearly 2%.

Stocks are coming off of a much-needed winning week, which saw the S&P 500 end Friday in the green and avoid four-straight weekly losses.

Investors remain jittery as Trump’s April 2 start date for reciprocal tariffs approaches, however. Trump has said the tariffs are aimed at any country that imposes duties on U.S. imports.

But the Wall Street Journal reported the tariffs are expected to be more narrow in scope and will likely exclude some industry-specific duties, citing an administration official. Trump will also exclude some nations from the tariffs, Bloomberg News reported. Both the WSJ and Bloomberg News reports noted that the situation remains fluid and the plans could change.

Trump seemingly lowered the temperature for investors on Friday after he told reporters that there could potentially be “flexibility” for his reciprocal tariff plan. That helped push major averages into the green for the session.

“Omitting the sectoral tariffs from the April 2nd package significantly reduces both its aggregate scale and the maximum rate on targeted sectors, given that all of Trump’s tariffs to date have been designed to stack,” stated Tobin Marcus of Wolfe Research in a note. “The ceiling for reciprocal tariffs on April 2 remains dramatic, and we still expect a negative market reaction, but the scale won’t be as severe and the sectoral impacts won’t be as concentrated.”

The pending duties and Trump’s overall rhetoric on U.S. trade policy have raised fears among investors that the U.S. economy could be on shaky footing. Those concerns were exacerbated by weakening consumer sentiment data. Stocks rapidly fell starting in late February with the S&P 500, at one point, closing in correction territory.

However, investors received some encouraging words from Federal Reserve Chair Jerome Powell, who last week said that any potential negative impacts from Trump’s tariffs will likely be short-lived. On the data front this week, investors will receive a consumer confidence reading on Tuesday, followed by initial weekly jobless claims figures on Thursday.

After last week’s small gain, the S&P 500 sits 7.8% off its record high. The Nasdaq Composite also snapped a four-week losing streak last week with a small gain and sits 12% off its record high.