Now Reading: Stocks in Asia Fall Sharply, Extending a Rout Caused by Trump’s Tariffs

-

01

Stocks in Asia Fall Sharply, Extending a Rout Caused by Trump’s Tariffs

Stocks in Asia Fall Sharply, Extending a Rout Caused by Trump’s Tariffs

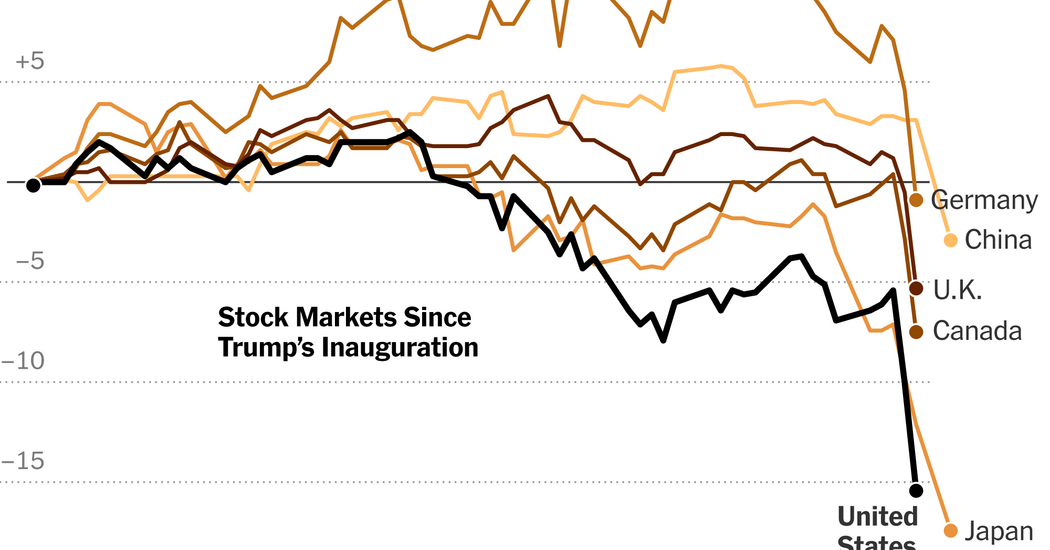

Financial markets in Asia were hit hard by another wave of selling on Monday, with investors and economists grappling with rising odds of a severe economic downturn caused by President Trump’s significant new tariffs on imports.

Trading was extremely volatile. Stocks in Japan plunged over 8 percent, while South Korea tumbled about 5 percent. In Australia, stocks fell more than 6 percent.

Over the weekend, analysts had circulated notes warning that Asia could be particularly vulnerable to a tit-for-tat exchange of retaliatory tariffs between China and the United States. Many countries in the region, including Japan and South Korea, count both nations as their top trading partners.

President Trump doubled down on Sunday evening, saying that he would not ease his tariffs on other countries “unless they pay us a lot of money.” He also dismissed concerns that his steep new taxes on imports will lead to higher prices. “I don’t think inflation is going to be a big deal,” he told reporters on Air Force One.

On Friday, China struck back at the United States with a 34 percent tariff on a number of American exports, matching a 34 percent tariff that Mr. Trump imposed on China last week.

On Monday, stock benchmarks in Hong Kong and Taiwan plunged about 10 percent when they started trading. Stocks in mainland China were down about half that amount.